What Is the Cap Rate Formula?

What is the cap rate formula? The cap rate formula is simply the first year net operating income (NOI) divided by the purchase price, as expressed in the formula below:

Cap Rate = Net Operating Income ÷ Purchase Price or Value

The resulting percentage shows the cash-on-cash return in the first year assuming the owner employs no debt financing. With just two pieces of information--NOI and purchase price--a prospective buyer can quickly compare one investment opportunity to another. For example, a buyer might find that property A can be purchased at a 5 cap while property B can be bought at a 6 cap.

How Do You Determine an Appropriate Cap Rate If the Purchase Price Is Unknown?

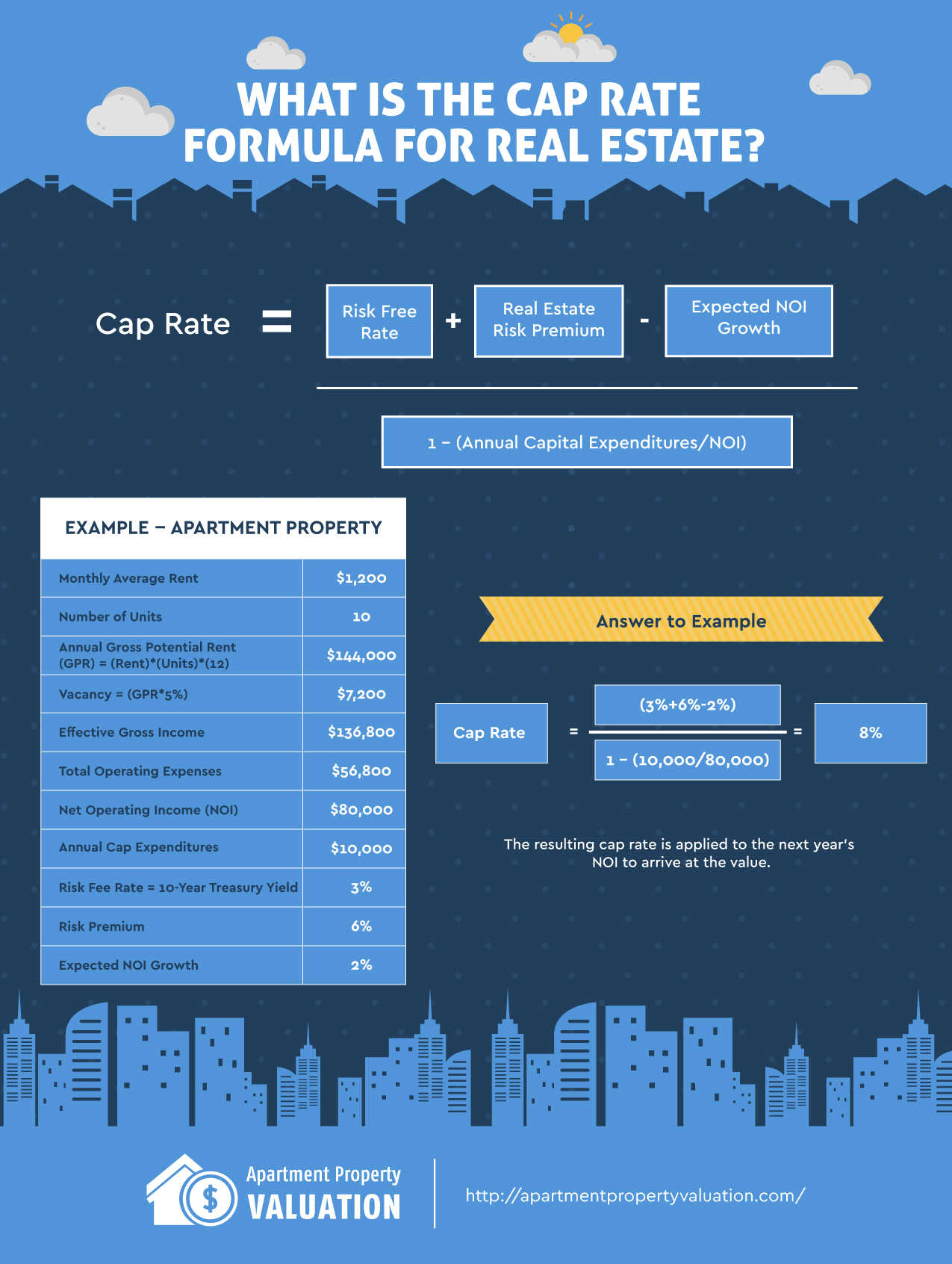

One approach is to look at cap rates from sales of comparable properties. But what if comparable sale data is unavailable? Or what if you think there is a real estate bubble, and it's making you reluctant to rely on cap rates from recent sales? In these instances, you can use historical risk premiums to determine what the cap rate should be using the formula shown below.