Apartment Property Tax Appeals

Your property's assessed value went up by 20% or more -- what should you do now to lower the tax bill?

It's always a little nerve wracking when a property tax assessment notice comes out for your apartment building. Even with your fingers crossed while reviewing the tax assessment notice, the assessed valuation inevitably goes up -- sometimes by a huge amount. In many cases, it can seem totally inconceivable how the property's value could increase by so much since the prior notice only a year earlier. Unless you take immediate action, your apartment property's cash flow could be confiscated by state and local government through taxation.

You have some options when faced with this predicament. The more you know about property valuation for apartments, the better equipped you'll be. Here, we outline the steps to take immediately following receipt of the tax assessment notice.

1. Calculate the NOI of your property excluding property tax

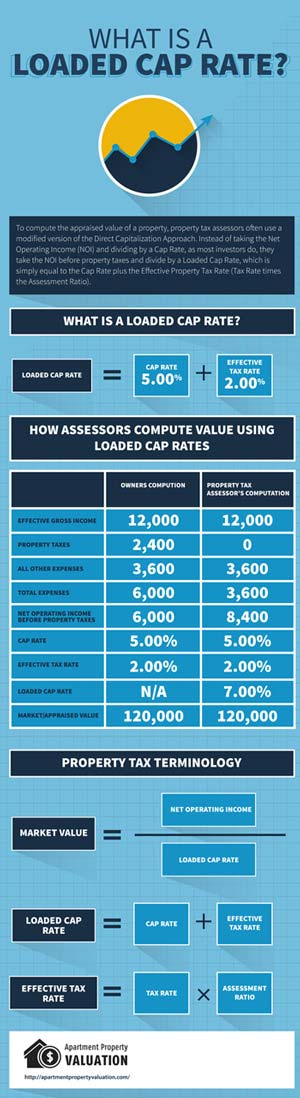

Most tax assessors use a modified version of the Direct Capitalization Approach to come up with the assessed value for apartment properties. Instead of dividing the Net Operating Income (NOI) by the Capitalization Rate, they find the NOI before property tax and then divided by a Loaded Cap Rate (see infographic). Figuring out your property's NOI before property tax is the first step. You can use the Property Tax Calculator to complete this initial, critical step.

2. Figure out what loaded cap rate is being used to value your apartment property

Next, you'll need to know the Loaded Cap Rate used by the assessor to value your property. Find out by asking the assessor. You may or may not agree with it. You can back out the Effective Tax Rate from the Loaded Cap Rate to see what Cap Rate the assessor used in computing the value. Then find the one assigned to your property by apartmentpropertyvaluation.com for comparison.

3. Look at assessment levels of comparable apartment properties

The assessor will likely compare assessment levels at your property to other comparable properties, and you should too. You can get assessment information by visiting the website of the county in which your property is located. Be sure to compare your property to the others by looking at valuations per unit and per square foot.

4. Determine the appropriate market value for your property

Once you've computed the stabilized before-tax NOI for your property and know the appropriate Loaded Cap Rate, go ahead and compute the valuation of your property. Use our calculator above to complete the calculation automatically. It takes just a few minutes. If the computed valuation is lower than the assessor's, proceed to the next step.

5. Call the assessor's office and speak to an appraiser there to resolve your differences informally before the appeals process

Call the tax assessor to discuss your computation. You may be able to resolve your differences without going through the appeals process. Most of the time, the discussion will center around the NOI, since tax assessors tend to use reasonable capitalization rates for apartment buildings. If you are able to settle, be sure to obtain documentation showing the agreed upon valuation.

6. Filing formal appeals

If you're unable to come to a satisfactory settlement, take the necessary steps to file an appeal by the applicable deadline. It's often just 30 days after the assessment notice goes out. To make sure this date doesn't fall by the wayside, mark your calendar with the appeals deadline. Take the time to find out whether appeals must be postmarked or actually received by that date.

7. Contact an attorney who specializes in property tax appeals

It is usually a good idea to get the help of a local attorney who specializes in apartment property tax appeals. The attorney can argue your case to the appraisal review board or may be able to settle the matter before the appeal hearing. Most attorneys will agree to a contingent arrangement whereby you pay a legal fee (usually about 1/3rd of the savings) for appeals only when there are positive results.